Protect generational wealth effectively using offshore trusts asset protection structures.

Protect generational wealth effectively using offshore trusts asset protection structures.

Blog Article

Comprehensive Approaches for Offshore Depend On Property Security Solutions

When it comes to shielding your possessions, offshore trust funds can offer substantial advantages. Guiding with the intricacies of offshore counts on requires careful preparation and understanding of various aspects.

Understanding Offshore Trusts: A Primer

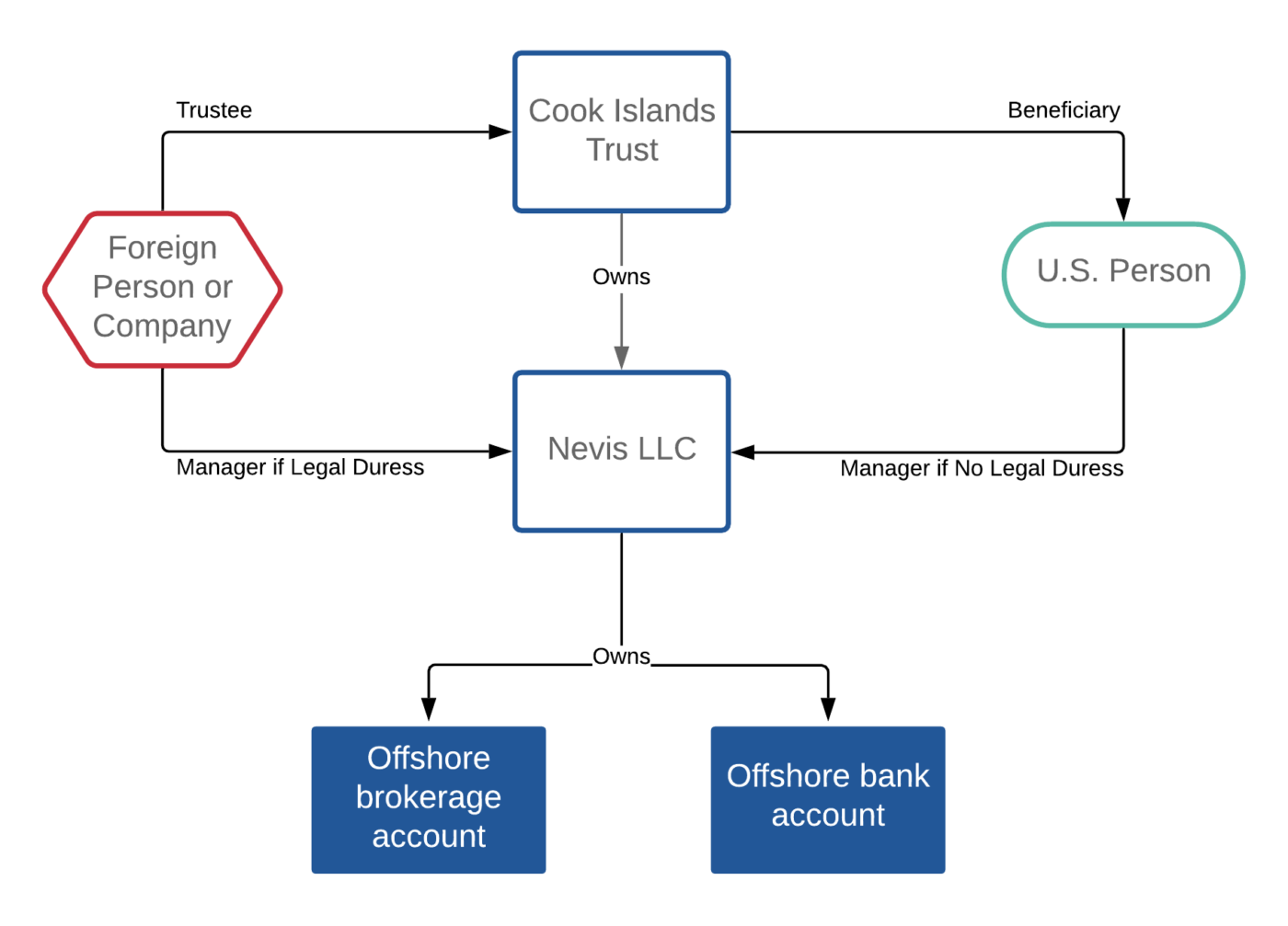

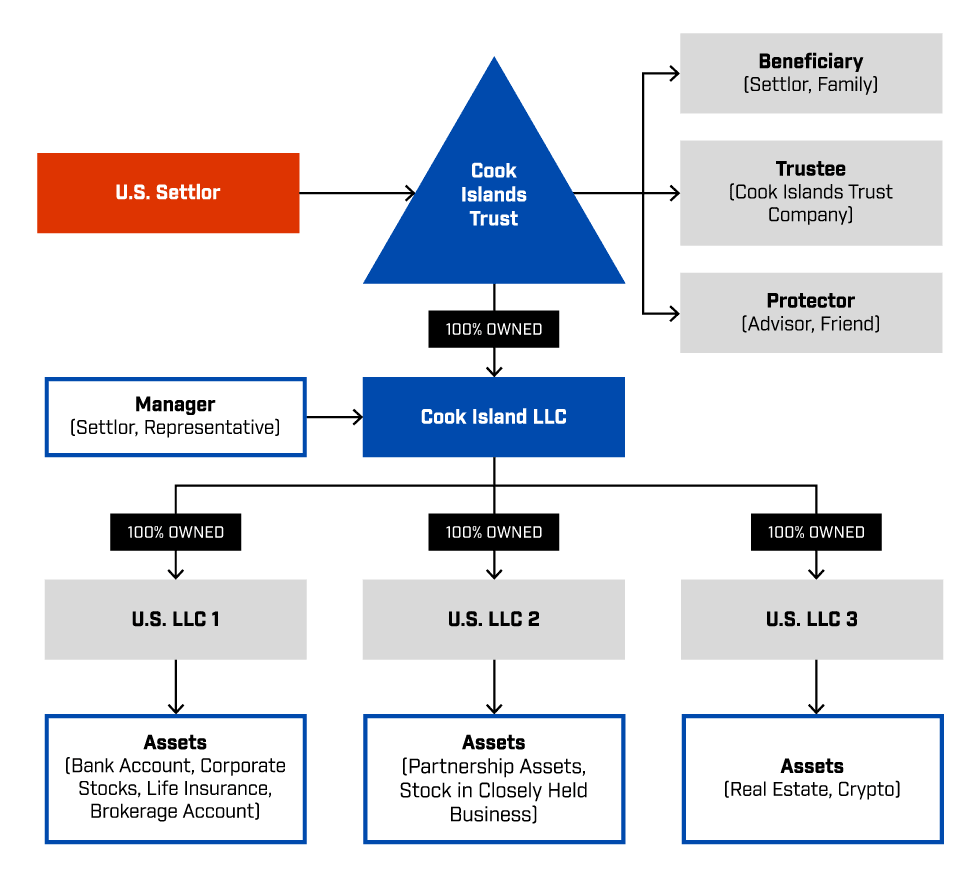

Have you ever wondered just how overseas trust funds can act as an effective tool for property security? An overseas depend on is fundamentally a lawful setup where you move your assets to a count on taken care of by a trustee in an international territory. This splitting up can shield your possessions from lenders and lawsuits. By putting your wide range in an overseas trust fund, you're not just shielding your properties; you're additionally acquiring privacy and possible tax obligation advantages, depending upon the territory.

You'll want to pick a respectable territory known for its solid asset security legislations. The trustee, that manages the trust, can be a specific or a business entity, and they are in charge of managing the possessions according to your instructions. It's crucial to comprehend the legal structure and guidelines regulating overseas count on your selected area. This fundamental knowledge will help you leverage offshore depends on properly for your economic security.

Secret Benefits of Offshore Count On Possession Protection

When you consider overseas trust fund asset protection, you disclose crucial advantages like improved personal privacy and tax optimization. These benefits not just protect your possessions from possible hazards however also assist you manage your tax responsibilities better. By recognizing these benefits, you can make educated choices that line up with your monetary objectives.

Improved Privacy Protection

How can offshore rely on possession defense improve your personal privacy? By placing your possessions in an overseas trust fund, you gain a layer of privacy that's hard to attain domestically. You can guard your identity given that the count on acts as a separate lawful entity, making it a lot more difficult for anybody to map properties back to you directly.

Tax Obligation Optimization Opportunities

While boosted privacy protection is a substantial benefit of overseas depends on, they additionally provide important tax optimization chances. By placing your assets in an overseas trust fund, you can possibly lower your tax obligation problem via critical planning. Additionally, offshore depends on can aid you take care of estate taxes, ensuring that even more of your wealth is maintained for your heirs.

Picking the Right Territory for Your Trust Fund

Picking the best jurisdiction for your depend on can considerably impact its effectiveness in asset protection. You'll intend to consider elements like lawful stability, privacy legislations, and the level of property protection they supply. Some jurisdictions supply stronger protections versus financial institutions and lawful cases, while others may prefer tax obligation advantages.

Research the track record of each jurisdiction and speak with specialists that recognize the nuances of overseas depends on - offshore trusts asset protection. Try to find locations with well-established lawful structures that support trust fund law. Furthermore, review the simplicity of establishing and preserving the trust, including any type of governmental obstacles

Sorts Of Offshore Trusts and Their Uses

Offshore counts on are available in different types, each tailored to meet details needs and goals. One usual type is the discretionary trust fund, where you can offer trustees the power to decide how and when to disperse possessions. This adaptability is excellent if you wish to protect possessions while permitting future adjustments in beneficiary requirements.

Another alternative is the spendthrift trust, developed to avoid beneficiaries from misusing their inheritance. It safeguards assets from creditors and warranties they're used intelligently. If you're concentrated on estate planning, a revocable depend on allows you to manage your possessions while you're active, with the capacity to make changes as needed.

Lastly, philanthropic depends on can provide tax benefits while supporting your philanthropic goals. By choosing the appropriate kind of offshore count on, you can properly secure your assets and achieve your financial purposes while taking pleasure in the advantages these frameworks offer.

Legal Conformity and Governing Considerations

When thinking about offshore trusts, you need to comprehend the legal frameworks in various territories. Conformity with local laws and reporting responsibilities is important to ensure your asset security strategies are reliable. Disregarding these laws can lead to considerable charges and weaken your trust fund's objective.

Jurisdictional Lawful Frameworks

Guiding via the complexities of jurisdictional lawful structures is important for reliable asset security approaches. Each territory has its own regulations regulating counts on, which can considerably influence your asset defense efforts. You need to recognize just how regional regulations affect the establishment and monitoring of overseas trusts. Research study the lawful criteria, tax effects, and compliance demands in your picked territory. This understanding aids you navigate prospective mistakes and assurances that your count on operates legally. In addition, consider exactly how different jurisdictions deal with financial institution insurance claims and discretion. By picking a desirable territory and sticking to its legal framework, you can boost your asset defense technique and safeguard your riches against unpredicted threats while staying certified with appropriate laws.

Coverage Obligations Conformity

Understanding your coverage obligations is critical for preserving compliance with legal and governing frameworks related to offshore trusts. You'll require to stay notified regarding the specific demands in the territories where your depend on runs. This includes filing necessary documents, revealing recipients, and reporting income produced by trust possessions.

Falling short to abide can result in substantial penalties, consisting of penalties and lawful issues. Routinely seek advice from with legal and tax specialists to assure you're satisfying all commitments. Maintain accurate documents, as these will their explanation certainly be essential if your compliance is ever before questioned. Sticking to your coverage responsibilities not just safeguards your properties however also enhances your trust's credibility. By prioritizing compliance, you safeguard your monetary future.

Methods for Making The Most Of Privacy and Security

To enhance your privacy and safety while utilizing offshore depends on, it's vital to apply a multifaceted method that includes mindful jurisdiction selection and durable lawful frameworks (offshore trusts asset protection). Start by picking a jurisdiction understood for its solid personal privacy regulations and asset protection statutes. Research nations that do not divulge count on information publicly, as this can secure your possessions from prying eyes

Following, think about utilizing a candidate trustee to additional click this range your identity from the trust. This can include an additional layer of privacy, as the trustee manages the properties without disclosing your individual information.

Furthermore, keep your depend on records safe and limit accessibility to them. Use encrypted interaction approaches when talking about trust-related issues, and stay clear of sharing delicate information unnecessarily.

Consistently assess your techniques and remain notified about any adjustments in legislations that may influence your privacy and protection. Taking these proactive steps can substantially boost the discretion of your overseas trust possessions.

Involving Specialist Advisors for Effective Planning

While traversing the intricacies of overseas trust funds, engaging specialist experts can considerably improve your planning efforts. These experts, consisting of attorneys, accounting professionals, and financial planners, bring specialized knowledge to the table, guaranteeing you browse the lawful and tax obligation effects successfully. They can aid you determine the finest territory for your depend on, taking into consideration aspects like property security laws and tax advantages.

By teaming up with these specialists, you can customize your depend on to fulfill your particular demands and goals. They'll additionally help in keeping compliance with developing guidelines, which is necessary for protecting your properties. In addition, consultants can offer ongoing assistance, helping you adjust your strategy as your situations alter.

Buying expert suggestions may appear pricey upfront, yet the lasting advantages, including enhanced security and tranquility of mind, far surpass the initial expenses. Don't think twice to seek out experienced experts who can direct you via this intricate process.

Regularly Asked Concerns

Exactly How Can I Guarantee My Offshore Trust Fund Continues To Be Certified In Time?

To ensure your overseas trust fund continues to be compliant with time, consistently evaluation regulations, engage a certified expert, and maintain exact records. Remaining informed about changes and adapting your trust as necessary will assist maintain its compliance and efficiency.

What Costs Are Connected With Establishing up an Offshore Trust Fund?

Establishing an overseas trust includes different costs, including lawful charges, management expenditures, and prospective tax obligation effects. You ought to likewise consider ongoing maintenance costs, conformity prices, and any costs from economic organizations entailed in taking care of the depend on.

Can I Adjustment Beneficiaries After Establishing an Offshore Count On?

Yes, you can alter recipients after developing an overseas trust. You'll need to adhere to the count on's terms and consult your attorney to ensure everything's done lawfully and according to your certain you can try here desires.

How Do Tax Implications Vary by Jurisdiction for Offshore Trusts?

Tax implications for offshore trusts differ considerably by jurisdiction - offshore trusts asset protection. You'll need to study each location's guidelines, as factors like income tax obligation rates, inheritance tax, and coverage needs can considerably affect your count on's economic results

What Occurs if I Die Without Updating My Offshore Count On?

If you die without upgrading your offshore trust, your assets could not be distributed as you intended. This could lead to disagreements amongst beneficiaries and potential tax obligation issues, inevitably undermining your initial estate preparation goals.

Final thought

In summary, maneuvering via overseas trust fund possession defense can be intricate, however with the ideal approaches, you can successfully secure your properties from prospective risks. By choosing a trustworthy jurisdiction, recognizing lawful structures, and collaborating with knowledgeable advisors, you'll optimize both protection and tax obligation advantages. Frequently assessing your trust fund's conformity guarantees it stays durable and lined up with your financial objectives. Take proactive actions now to guard your future and improve your tranquility of mind.

Report this page